Movements of the Bitcoin price in 2025 seem to be grabbing attention all over the world, not just from cryptocurrency traders as the markets shift into the lively phase of the calendar year, but also from hedge funds and central banks to ordinary individual investors. The blocks of coins and the entire altcoin domain experienced sustained growth in value throughout the closing months of 2022 and now, in 2023, with the recession paused, the world is asking whether Bitcoin will finally become a quintessential financial instrument.

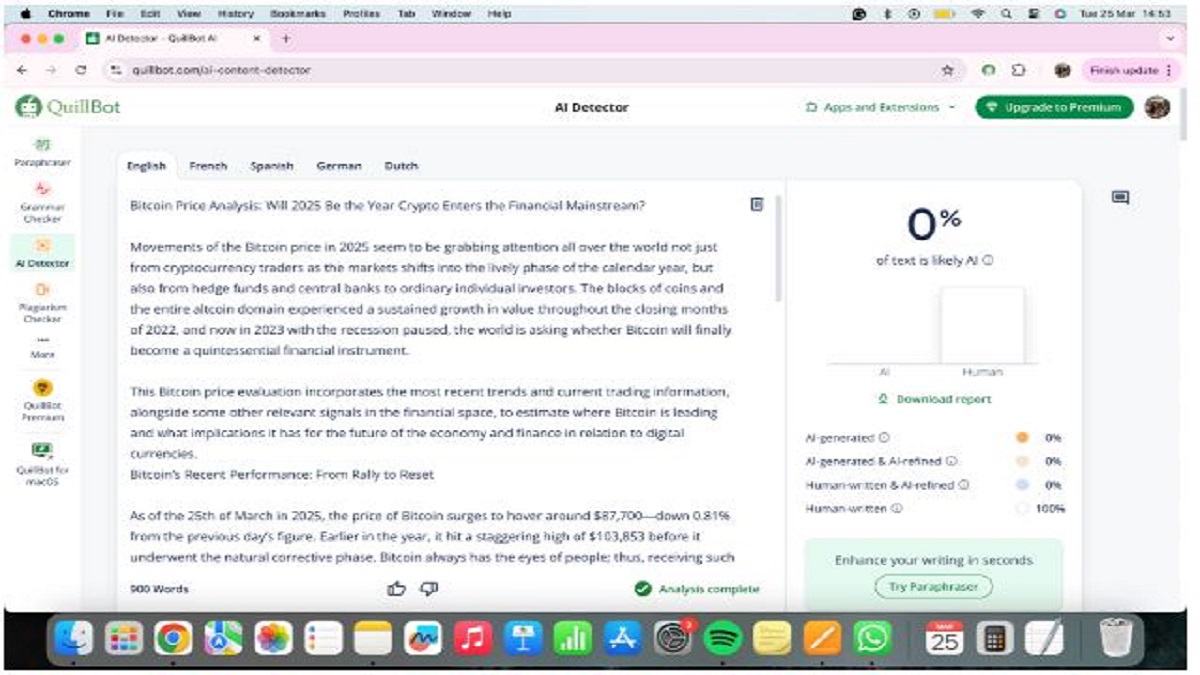

This Bitcoin price analysis incorporates the most recent trends and current trading information, alongside some other relevant signals in the financial space, to estimate where Bitcoin is leading and what implications it has for the future of the economy and finance of digital currencies.

Bitcoin’s Recent Performance: From Rally to Reset

As of the 25th of March in 2025, the price of Bitcoin surges to hover around $87,700—down 0.81% from the previous day’s figure. Earlier in the year, it hit a staggering high of $103,853 before it underwent the natural corrective phase. Bitcoin always has the eyes of people; thus, receiving such attention tends to invite volatility.

With a reported exposure of over $25 billion, Coin Glass states that open interest in Bitcoin futures remains above average. Spot volume data suggests that both retail and institutional investors are still active in the market.

What Are The Possible Reasons For Bitcoin’s Price Changes Over Time In 2025?

Here are a few of the factors driving Bitcoin’s price this year:

- Halving Impact: The previous halving in 2024 was bearish as it cut the mining rewards in half from 6.25 BTC to 3.125 BTC. This is still negative by capping supply.

- Macroeconomic Conditions: Given the inflation between 4 and 6% in the EU and some parts of Asia, Bitcoin is getting recognition as an investment differentiator.

- Institutional Activity: Bitcoin continues to draw interest from institutions that set allocations to digital assets. The wallet address paints a dull picture, but Microstrategy continues to buy Bitcoin and make blunt observations.

Bitcoin Layer 2 Expansion and Network Growth

The Bitcoin ecosystem is becoming increasingly sophisticated through the integration of its Layer 2 solutions, which enhance features and transaction volume on the Bitcoin network. As the Lightning Network scales, it becomes more reliable, leading to cheaper and faster transactions globally.

Though the exact number is in dispute, the growth in public channels in conjunction with node count suggests that the infrastructure is maturing. Other platforms like Stacks are also expanding the scope of the smart contract on Bitcoin, increasing its utility beyond the primary currency.

Regulation: Constructive Shifts on the Horizon

The 2025 regulations seem to shift toward regulation with less hostility, dampening the market, unlike prior years. Rather, they are facilitating market clarity and building institutional trust.

In March of this year, India's government implemented changes to cryptocurrency taxation and compliance policies in order to try and bring some order to the market without unlimited control. On the other hand, the European Union's Markets in Crypto-Assets (MiCA) legislation is expected to come into full force by mid-2025, which will provide more comprehensive guidelines regarding the trading, custody services, and token issuing of digital assets.

A March 2025 Fidelity survey notes that 48% of institutional investors stated that they would be more willing to invest in crypto assets if the regulations were made clear.

Technical Levels to Watch: Resistance and Support Zones

Currently, Bitcoin is trying to break key resistance at $87,800. If this mark is breached, it’s possible there may be a bullish march towards $92,000 or even $95,000 in the near future.

Technical analysis by ForexLive shows there’s support around $86,645 and the next significant level is $84,000. Market sentiments remain cautiously optimistic, with bulls defending key levels while on-chain activity suggests continued interest.

Real-World Use Cases Continue to Rise

Bitcoin is being increasingly relied upon by some regions facing tough economic straits. For example, in Argentina, with year-on-year inflation of greater than 200%, there has been a spike in peer-to-peer Bitcoin transactions.

The same phenomenon is happening in Nigeria and Turkey, where Bitcoin wallet registration and trading volumes are at an all-time high as the currency proves to be more appealing for value preservation during uncertain times.

Bitcoin’s Cultural Footprint Is Growing

Bollywood is embracing cryptocurrency. Ranveer Singh, a Bollywood actor, spoke about the crypto market on Koffee With Karan, which garnered over two million views on X (formerly Twitter). Singh's comments underscored the growing popularity of Bitcoin.

Simultaneously, platforms like TikTok and Instagram Reels are flooded with Bitcoin explainer videos directed towards younger audiences. The March 2025 Statista report revealed that 47% of crypto holders in the Asia-Pacific region are below the age of 30, reinforcing Bitcoin’s generational appeal.

Conclusion

This Bitcoin price analysis showcases why 2025 could be a tipping point year for the crypto industry. Bitcoin's characterization as a speculative asset' is changing as an increasing number of institutions start investing alongside the rapid development of Layer 2 and clearer regulations being enforced. These factors underscore Bitcoin's evolution into a more mature and integrated component of the global financial system.

While volatility will always be part of the narrative, the ever-changing role of Bitcoin in finance and technology makes it a priority that the global market needs to pay attention to.

(All articles published here are Syndicated/Partnered/Sponsored feed, LatestLY Staff may not have modified or edited the content body. The views and facts appearing in the articles do not reflect the opinions of LatestLY, also LatestLY does not assume any responsibility or liability for the same.)

Quickly

Quickly